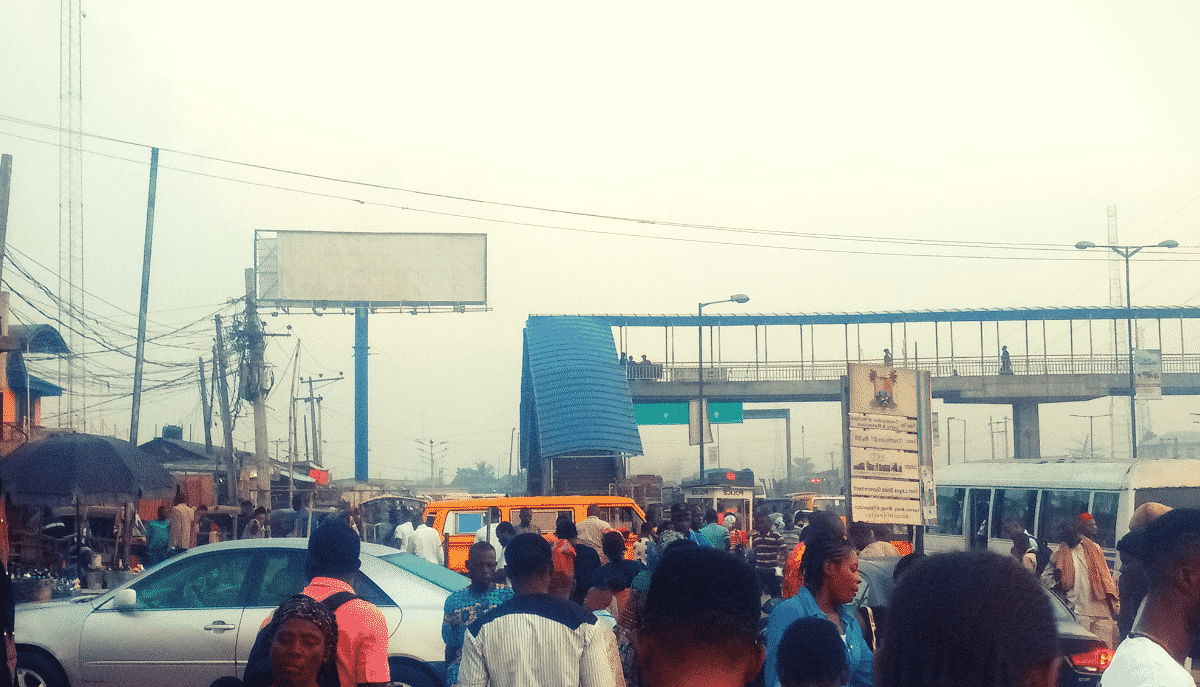

The growing incidence of low compliance in the Nigerian out-of-home (OOH) advertising supply chain is a big issue for advertisers and other stakeholders in the industry. On the one hand, advertisers are losing media investment and hitting short of their marketing goals and objectives, while on the other, advertising and media buying agencies are losing big on billings and professional integrity. Compliance in the advertising media monitoring parlance refers to the ability of the media owner or the media buying agency to deliver advertising campaigns in accordance with the agreed schedule of media purchase. One of the key measures of media compliance is the